Turn Chaos Into Capital

Stop chasing investors across email threads.

Structure your round like the pros do.

Know who's ready to wire—right now.

Issuer-direct; Deal Box is not a broker-dealer.

Watch Money Move

Trusted by Hundreds of Startup Founders and VC Funds

Stop chasing. Start closing.

The complete capital raise infrastructure.

Choose Your Exemption

Compliant portals, ready to share

Investors ghost when you go quiet.

You closed 50 intro calls. Three months later, radio silence. The problem isn't your deal—it's that you disappeared.

See how updates workInvestor Updates

Automated engagement campaigns

Auto-send when revenue hits $50K

Triggers when you add to team

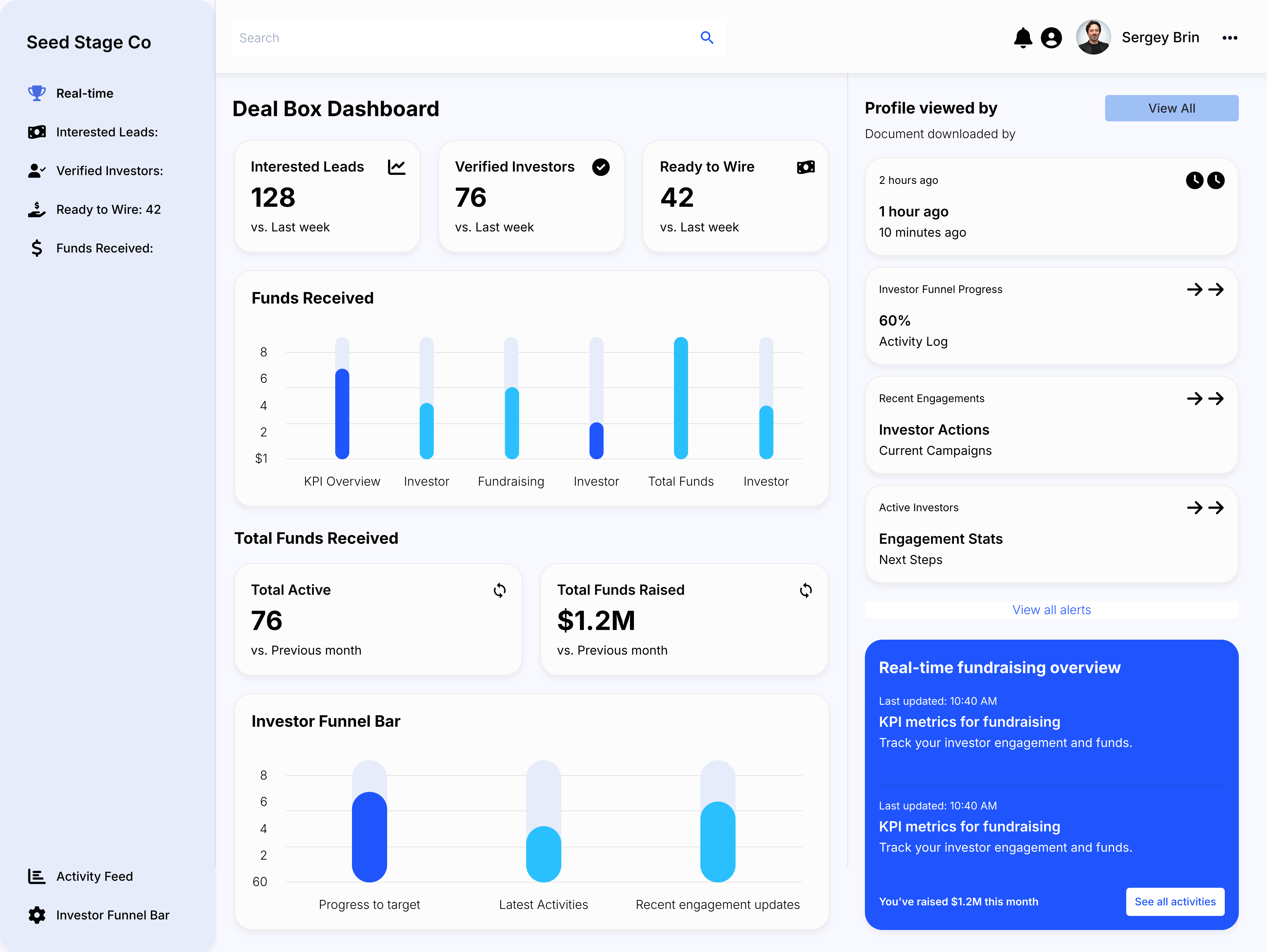

Investor Pipeline

Real-time engagement scoring

Spreadsheets lie. Engagement doesn't.

Your pipeline says 40 "interested" investors. But who's actually in the data room?

See the investor CRMSome teams need more than software.

You've got the vision. We bring the structure, the docs, and the expertise.

DIY materials won't cut it.

Serious investors need a PPM, real financials, and a proper data room. Ready in 6-8 weeks.

See PricingLatest Perspectives

Market insights and analysis from the Deal Box team. Fresh perspectives on private markets, tokenization, and capital formation.

Real results from founders who turned structure into capital.

Any early stage company looking to raise funds is going to want to use Deal Box. It will save them a lot of time and energy.

Deal Box was the most important partner for completing our raise and understanding how to best position our company for the future.

Deal Box's Investment Packaging brought structure and clarity to ONVI's raise — helping us communicate our value to investors with one organized, credible platform.

Ready to Get Started?

Schedule a demo to see how Deal Box can transform your capital formation process.

Start for Free